State of the Industry: How Foundries Plan to Weather 2022

Foundries are facing the same challenges that most businesses are facing this year: limited workforce, parts scarcity, and shipping bottlenecks. It is both unprecedented and familiar at the same time. For years, foundries have had to remain flexible as order volumes increase and decrease in sync with the price of raw materials. We asked industry experts to weigh in on how 2022 will be different.

Using the Past to Predict the Future

Raymond Monroe, executive vice president of Steel Founders Society of America (SFSA), serves steel casting producers and industry leaders who are committed to manufacturing products and advancing practices through collaboration and innovation. SFSA keeps a pulse on the industry by monitoring the price of raw materials, working with the U.S. Department of Commerce and Department of Defense, learning from peers in the scrap and steel mill industries, and consistently communicating with SFSA members.

“Where steel production, shipments, and pricing help foundries understand supply, other factors can indicate future customer demand,” Monroe said. “The price of copper is a bellwether of the mining industry – new equipment and facilities require copper, so if there is heavy activity there it pushes the price up. Increases in the price of oil can tell us a few things – an investment in energy infrastructure, a booming economy with more people using gasoline and natural gas, or a response to supply and demand. If the oil and gas industries are profitable, companies may be looking to buy more pumps and valves to expand and upgrade their operations.”

SFSA positions pricing data against feedback it receives from foundry members to identify trends and even send warnings when necessary. If foundries have a backlog when the price of raw materials is high and orders are conservative, the businesses are in a good position. However, if prices drop and businesses are not in a place to sustain an influx in orders and order volume, they suddenly find themselves at a critical crossroads.

This has been a common scenario for decades, according to Camillo Santomero, Managing Director of Guard Hill Holdings. Guard Hill is a team of experienced operating and financial partners that have invested their own capital in over 40 private equity transactions over the past 20 years, including Stainless Foundry & Engineering (SF&E). Santomero is a controlling equity investor in SF&E and sits on the board of directors. Guard Hill’s goal is to make investments in U.S.-based companies that they can use to improve, become more competitive and increase profitability in the long-run.

“Our original investment in Stainless 10+ years ago was on the premise that the foundry industry was ripe for consolidation – there were way too many competitors, way too many small companies in the industry,” Santomero said. “We thought if we could find a company with the right niche, a company that has a real specialty and real competitive advantage within the industry, we could make investments that would help it capitalize on this consolidation going on in the industry.”

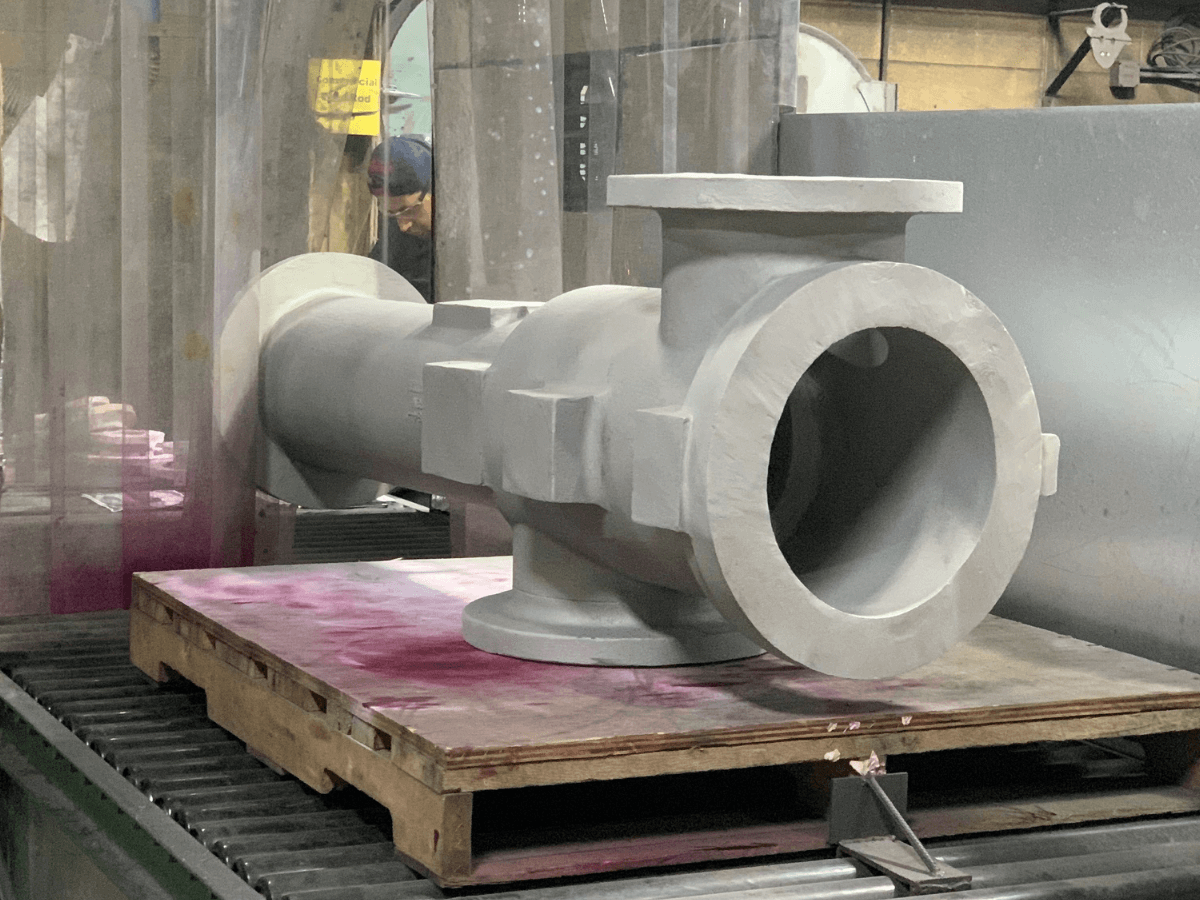

Guard Hill saw SF&E as a company with a solid protected niche – SF&E pours a wide variety of alloys, offers sand and investment casting, and produces shorter runs of nearly any size casting. They injected SF&E with capital investment for equipment, processes improvement, technology, and top talent. Not only has SF&E been able to survive recent shocks to the industry, including the COVID pandemic, but it has been able to take on parts from OEMs suddenly finding themselves with a foundry partner who had shut down, or was unable to produce parts at a consistent quality and timeframe.

“OEMs are not just buying based on price, they are buying based on the service and long-term viability of the supplier,” Santomero said. “The number of patterns we produce at SF&E and the customers we serve has increased substantially over the last two to three years, which has allowed us to continue to invest and grow our business.”

According to Monroe and his team at SFSA, the foundry industry will need to weather a unique storm this year, making a strong workforce and an eye toward innovation critical.

The Next Generation Workforce

From an SFSA standpoint, workforce limitations stem from issues that have been a long time coming. Even with industry-wide wage increases and recruitment bonuses, people who enjoy the labor intensity of a foundry are getting harder to come by.

“There are not many workers interested in jobs at foundries even when they are paid a premium for the work – especially the younger generation,” Monroe said. “They are not as motivated by small changes in compensation – they would rather make less money to have a comfortable job.”

SFSA is looking to close the generational gap through exposure. SFSA’s annual Cast in Steel competition not only challenges university students to use modern casting tools to design and produce a functioning object (like a Celtic Leaf Sword or Thor’s Hammer), but they work in partnership with foundries.

“This year, 35 teams from 20 universities are entered in the competition,” Monroe said. “When the students see the process of designing and making a casting, they get excited about the possibility of working at a foundry. It has been a great recruiting tool.”

SF&E has focused on career advancement to recruit and retain engineers and foundry talent. When a multi-phase, multi-year capital investment initiative at SF&E uncovered that the foundry could drastically improve operating efficiency if SF&E operators were cross-trained, SF&E provided additional training and certification for welding and testing. Now, high specification operators can complete more focused and versatile work when it comes to inspecting, repairing, and final quality approval; and welders are specifically certified in various alloys. It allows for skill development, pay increases, and with more senior staff, SF&E has the ability to add second shifts and additional personnel to increase production capacity.

“Foundries need employees at every level who embrace modern manufacturing techniques,” Santomero said. “SF&E tends to hire younger employees because they are savvier when it comes to technology. Then we invest in their training to develop their skill level. We have more engineers on staff than most in the industry. We are metallurgists at heart. We believe in the process and work to continually improve it.”

Industry Innovation

Innovations in alloys, design capabilities, and operations will become mandatory for the industry this year. Innovation will help solve workforce limitations, supply chain disruptions, and inflation challenges – none of which are going to go away on their own.

“To be competitive you need modern systems for both manufacturing and accounting,” Santomero said. “What you find in smaller foundries is that they have neither.”

Once modern system is automation. Industrial robots can load, transport, and unload heavy parts and materials; perform finishing work; reset lines for different part runs; and more. The trick is to make sure they can adapt for making limited quantities.

“If we can find a way to automate processes that are repetitive and physically difficult, we can get the next generation interested in a foundry career,” Monroe said. “We can also increase productivity significantly. Robots can do one task several hundred times per day, where currently an employee only has the time to do the same task two or three times.”

Accounting automation gives foundries access to cost, lead time, and profitability data of completed parts at their fingertips, making a business faster and better and quoting a rational price, according to Santomero. And leveraging software to schedule production and communicate updates improves internal processes, customer experience, and provides the ability to track a product at every stage of manufacturing. That way, the system can automatically alert foundries when a part is in danger of not finishing in time so they can do what they need to get it back on schedule.

Innovation also extends to the raw materials themselves. SFSA is part of a $10-million-per-year congressional program involving 14 universities that is focused on advancing steel technology, according to Monroe. They are looking to develop the next generation of high performing steel by increasing strength and reducing weight. U.S.-based steel production would also reduce the industry’s dependence on global sources for raw materials.

“The federal government now recognizes that they have discouraged capital investment in industries like foundries,” Monroe said. “We are working with the U.S. Department of Defense to make dramatic changes in public policy to re-regionalize business away from globalization and invest in the modernization of U.S. companies.”

Investment and innovation will help foundries become more efficient without sacrificing quality, and better prepared to stay afloat when order volume drops and ramp up when customers need more parts. Most importantly, they will keep a foundry viable for the long run – a sustainable, dependable partner for the OEMs it serves.

If you are considering a new or expanded foundry partnership, we are here to help. Contact us at sales@stainlessfoundry.com.